Corporate Governance

We comply with laws and the articles of incorporation to establish an effective corporate governance system. Additionally, we are committed to safeguarding shareholders rights, ensuring equitable treatment of all shareholders, strengthening the structure and operation of the board of directors, enhancing information transparency, protecting the interests of stakeholders, and fulfilling corporate social responsibility.

Major Shareholders

| Name | Shares | |

|---|---|---|

| Shareholding | Percentage(%) | |

| Min Aik Technology Co., Ltd. | 29,857,000 | 38.78% |

| Beacon Investment Limited (Malaysia) | 22,756,000 | 29.55% |

| Taiwan Fu Hsing Industrial Co., Ltd. | 1,500,000 | 1.95% |

| Wang, Chung-Chi | 1,034,000 | 1.34% |

| Fang, Kuang-Yi | 732,022 | 0.95% |

| UBS Europe SE Investment Account | 661,063 | 0.86% |

| LGT Bank (Singapore) Ltd. | 444,000 | 0.58% |

| Chia, Kin-Heng | 439,766 | 0.57% |

| CTBC Bank Employee Stock Ownership Trust Account of Min Aik Precision Industrial Co., Ltd. | 399,725 | 0.52% |

| Hsu, Chien-Hung | 361,000 | 0.47% |

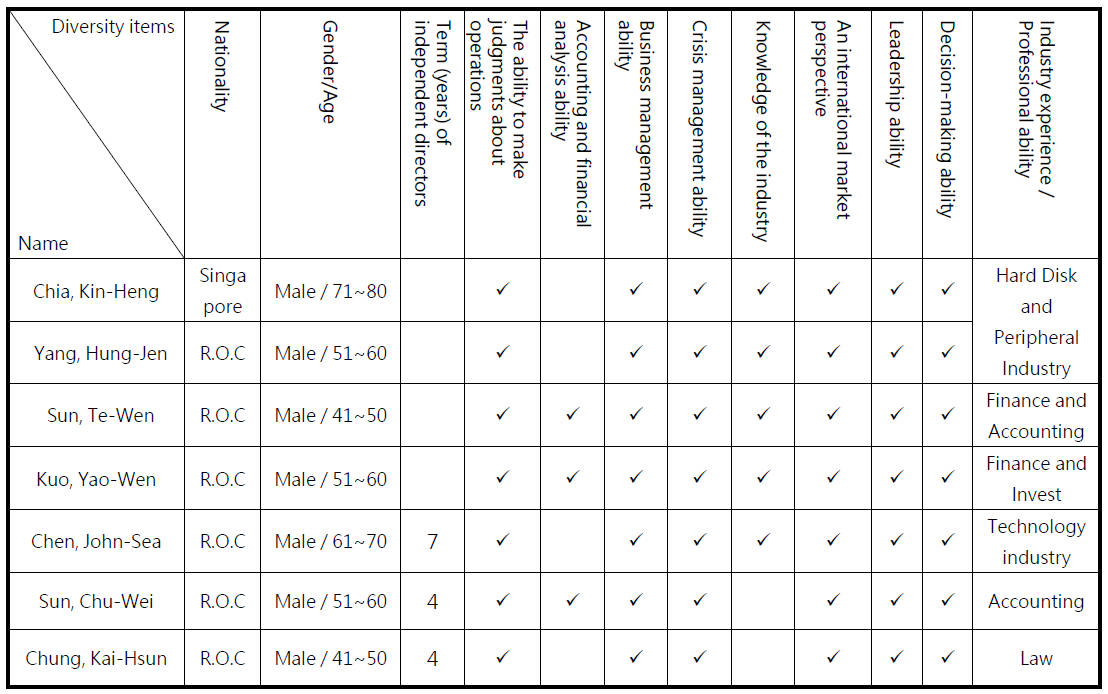

Diversity Policy of The Board

In order to strengthen the functions of the Board, the Company's “Corporate Governance Best Practice Principles” specifies that the composition of the Board of Directors should be diversified to ensure that the Board as a whole can have operational judgment, operational management and analytical oversight capabilities, and in the Company's “Procedures for Election of Directors” Establish a policy of diversity of board members. The company’s board member diversity policy is as follows:Article 3 of “Procedures for Election of Directors”

The overall composition of the board of directors shall be taken into consideration in the selection of this Corporation's directors. The composition of the board of directors shall be determined by taking diversity into consideration and formulating an appropriate policy on diversity based on the company's business operations, operating dynamics, and development needs. It is advisable that the policy include, without being limited to, the following two general standards:

1.Basic requirements and values: Gender, age, nationality, and culture.

2.Professional knowledge and skills: A professional background (e.g., law, accounting, industry, finance, marketing, technology), professional skills, and industry experience.

Each board member shall have the necessary knowledge, skill, and experience to perform their duties; the abilities that must be present in the board as a whole are as follows:

- The ability to make judgments about operations

- Accounting and financial analysis ability

- Business management ability

- Crisis management ability

- Knowledge of the industry

- An international market perspective

- Leadership ability

- Decision-making ability

Implementation of board member diversity policy:

- The 10th Board of Directors of the Company consists of 4 General Directors and 3 Independent Directors. Among them, the directors with employee status accounted for 0%, female directors accounted for 0%; The 2 Independent Directors are appointed for a period of 4 years, 1 Independent Director is appointed for a period of 7 years; The 1 directors are between 71 and 80 years old, 1 directors are between 61 and 70 years old, 3 directors are between 51 and 60 years old, 2 director is between 41 and 50 years old, the average age of all directors is about 57 years old. There are no spouses or relatives within the second degree of kinship among the 7 directors.

- Individual members have the necessary abilities to perform their duties as follows:

- Specific management objectives and implementation status of the board member diversity policy:

Diversification Specific management objectives Achievement Gender At least one female director - Expertise or Background At least one qualified accountant V At least one qualified lawyer V

Management of the Prevention of Insider Trading

1.Regarding the company's management to prevent insider trading, please refer to the "Procedures for Handling Material Inside Information".

2. In order to protect the rights and interests of shareholders and implement equal treatment of shareholders, the "Internal Material Information Processing Procedures" formulated by the board of directors prohibit insiders such as directors or employees from buying and selling the company's securities as follows:

-

If a person as defined in Article 157-1 of the Securities and Exchange Act has actual knowledge of the company's news that has a significant impact on the stock price, he shall not make any comment on the company's information after the news becomes clear, before it is made public or within 18 hours after it is made public. Buying or selling stocks or other equity securities by oneself or in the name of others.

-

The Company's directors, managers and their related parties are not allowed to trade their stocks during the closed period of 30 days before the announcement of the annual financial report and 15 days before the announcement of the quarterly financial report. The board meeting unit shall notify each director and manager of the scheduled board meeting date, financial report date and closed period for the next year, and remind them again before each closed period.

3. Specific implementation status of preventing insider trading in 2025

(1) Arrange directors to attend relevant publicity meetings held by the competent authorities for a total of 4 people and 12 hours.

(2) Regularly educate all directors, managers and employees on the Internal Material Information Processing Procedures and the prevention of insider trading.

Ethical Corporate Management Policies

1. In order to foster a corporate culture of ethical management and sound development, our company has established the " Ethical Corporate Management Principles" as a reference framework for establishing good commercial practices. This Principle is also applicable to our subsidiaries.

2. Based on the principles of fairness, honesty, faithfulness, and transparency in business activities, and to implement the policy of ethical management while actively preventing unethical behavior, the company has established the " Procedures and Guidelines for Ethical Business Conduct," which specifically outlines the matters that employees should pay attention to when carrying out their duties.

3. Operational Service Office is authorized by the company to be responsible for developing and dealing with ethical corporate management related matters for the company and its subsidiaries, and reporting the status of performance of the previous year to the Board of Directors every year.

4. Ethical management education and training held by the company in 2025:

In 2025, the company held internal and external education and training related to ethical corporate management issues for a total of 134 people and 203 hours.

(Including employee ethics management procedures, ethics management, ethical management and compliance with laws, accounting systems and internal control and other related courses)

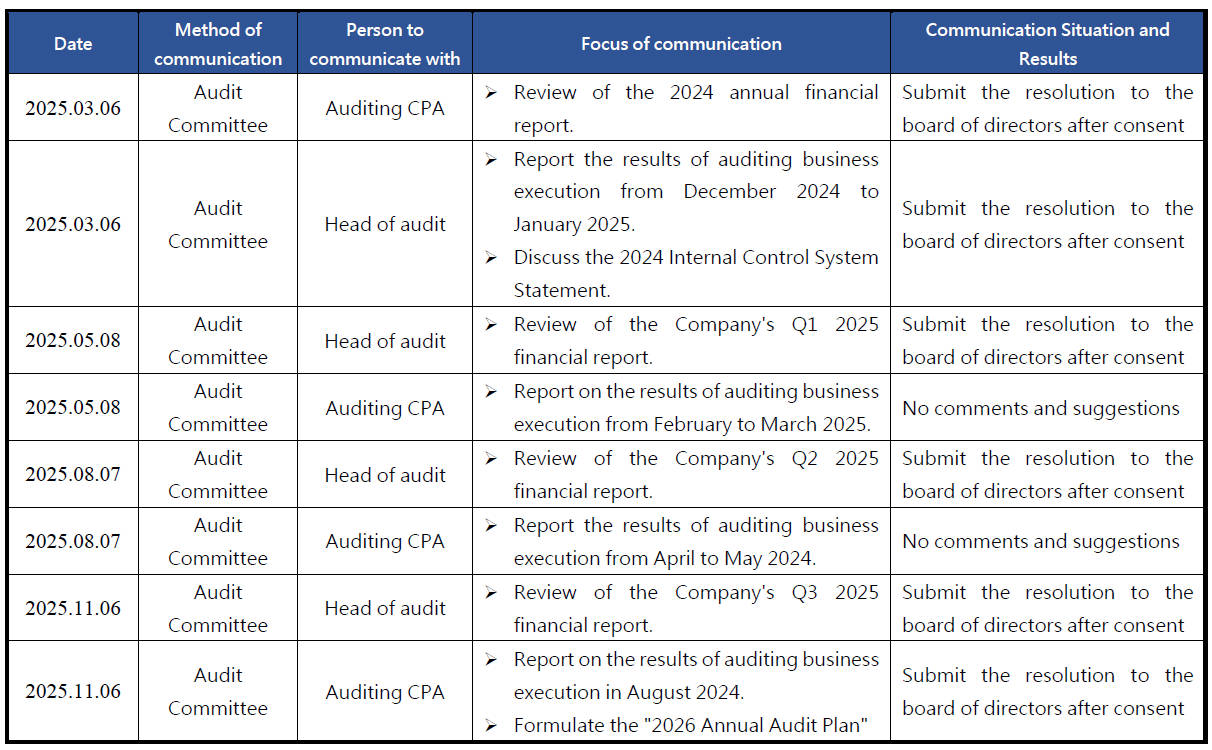

Communications between the independent directors, the Company's chief internal auditor and CPAs

1. All independent directors were members of the audit committee. They not only had to review the audit report of the head of internal audit periodically and communicate with the head of internal audit, but also should invite the head of internal audit to report at the meeting of the audit committee, if necessary.

2. Certified public accountants were also invited periodically to fully explain certification of financial statements of the company and relevant internal control and audit at the meeting of the audit committee.

3. Frequency of independent communication between independent directors and Head of audit and CPAs: Head of audit at least once a quarter; CPAs at least twice a year.

4. Communication situation this year:

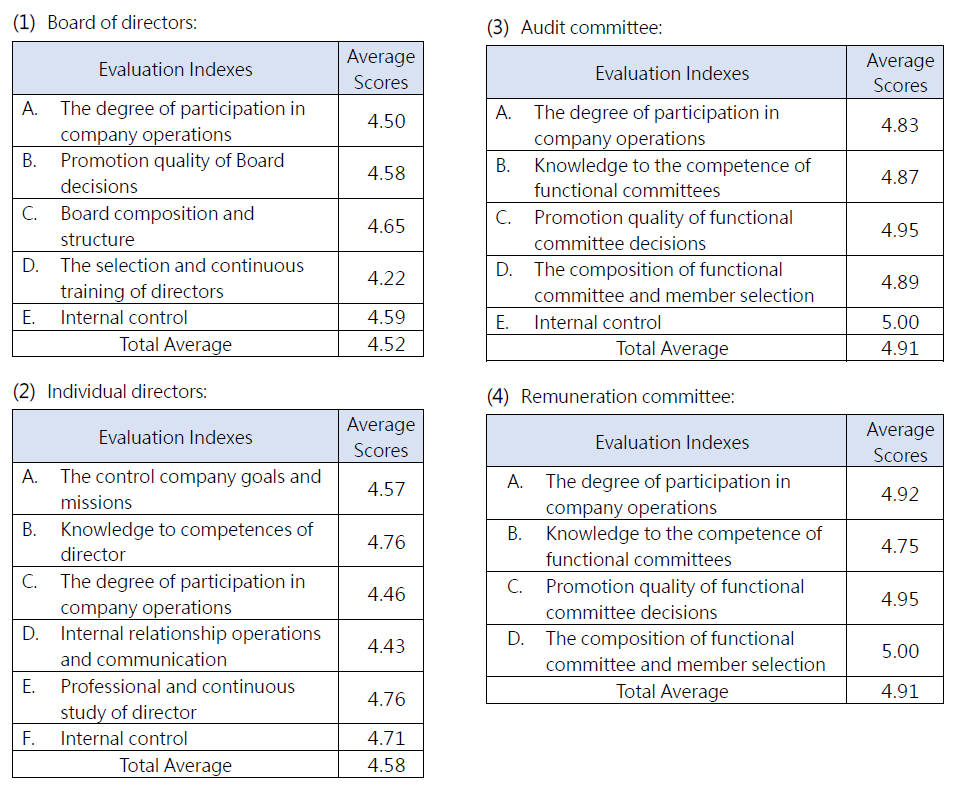

Board Performance Evaluation

In order to implement corporate governance and enhance the Company's board functions, and to set forth performance objectives to improve the operation efficiency of the Board of Directors, the Board of Directors established the “Rules for Performance Evaluation of Board of Directors” on August 8, 2019.:

Evaluation Cycle:

- The Board of Directors shall conduct a self-performance evaluation annually.

- The Board of Directors should conduct a performance evaluation at least once every three years by an external professional independent body or external experts.

Evaluation Scope and Method:

- The scope of the evaluation includes the Board, Individual directors and Functional committees.

- Evaluation methods include internal self-evaluation of the Board, Committees, and Directors, appointment of external professional organizations, experts or other appropriate methods to conduct performance evaluation.

Execution unit:The internal evaluation unit of the Company is the agenda working group.

Evaluation procedures: At the end of each year, the executive unit collects information about the activities of the board of directors and distribute self-evaluation questionnaires such as Annex 1 to 4. The execution unit finally collects the assessment results according to the scoring standards of the evaluation indicators in Article 8 and submits them to the board of directors for discussion and improvement.

External professional institutions and experts:

- The external evaluation institution or panel of external experts and scholars shall be professional and independent.

- The external evaluation institution shall be an institution or management consulting firm mainly engaging in the provision of services for educational and training programs for board of directors and improvement of corporate governance of enterprises.

- The panel of external experts and scholars shall appoint at least three experts or scholars specialized in the fields of board of directors or corporate governance to conduct evaluations of board performance of the company and prepare external evaluation analysis reports.

Evaluation indexes:

- Board performance evaluation includes five major directions: the degree of participation in company operations, promotion quality of Board decisions, Board composition and structure, the selection and continuous training of directors, and internal control, with 45 indicators in total.

- The performance evaluation of individual directors includes six major directions: the control company goals and missions, knowledge to competences of director, the degree of participation in company operations, internal relationship operations and communication, professional and continuous study of director, and internal control, with 23 indicators in total.

- The performance evaluation of the audit committee includes five major directions: the degree of participation in company operations, knowledge to the competence of functional committees, promotion quality of functional committee decisions, the composition of functional committee and member selection, and internal control, with 22 indicators in total.

- The performance evaluation of the remuneration committee includes four major directions: the degree of participation in company operations, knowledge to the competence of functional committees, promotion quality of functional committee decisions, and the composition of functional committee and member selection, with 18 indicators in total.

Application of evaluation results:When the company elects or nominates board members, the election should be based on the performance evaluation results of the board of directors, and the individual directors' remuneration should be determined based on the performance evaluation results of the directors.

Board performance evaluation execution results

【Internal Evaluations】

1. The company completed the internal evaluation of the board of directors, board members and functional committees for the year at the end of 2025. Most of the average scores of the evaluation results for each aspect were between 4.5 and 5 points, indicating that the company's overall operation is perfect. Comply with corporate governance requirements.

2. In addition to being submitted for board discussion and improvement in the first quarter of 2026, the evaluation results will also serve as a reference for future director nominations, as well as for setting individual directors' salaries and remuneration.

3. Evaluation results:

【External Evaluations】

I.External professional independent institutions

1.In 2025, the Company commissioned the Taiwan Corporate Governance Association (TCGA) to conduct an external board effectiveness evaluation. The assessment covered five key dimensions: Board Composition and Distribution of Responsibilities, Guidance and Supervision, Delegation and Risk Management, Communication and Collaboration, and Self-Discipline and Continuous Improvement. The evaluation process included a document review followed by a video interview conducted on December 5, 2025. The TCGA appointed an assessment team consisting of Executive Members Hung Ying-Cheng(洪英正) and Yu Kuang-Hua, (余光化) along with Senior Manager Lu Shu-Man(呂淑滿) and Specialist Chiang Chia-Jung(蔣嘉蓉). By engaging an independent professional institution to review the operations of the Board and its functional committees, the Company has undergone a professional and objective "health check" through the expert guidance and exchange provided by the assessors. .

2.The Taiwan Corporate Governance Association is an independent non-governmental/non-profit corporate body that provides professional corporate governance system assessment and board of directors effectiveness evaluation services in Taiwan.

II.Summary of Assessment Recommendations:

1.Board Diversity:Although the Board has diverse professional expertise, all directors are male. It is recommended to consider gender balance and tenure planning in future board composition, including the appointment of female directors, to enhance governance and decision-making quality.

2.Sustainability and Risk Management Oversight:It is recommended that independent directors participate in the Sustainability Committee and that risk management be elevated to board-level oversight to strengthen sustainability governance and risk management.

3.Internal Audit and Audit Committee Mechanism:It is recommended that the Audit Committee’s input be incorporated into the performance evaluation of the head of internal audit, and that written records of closed-door meetings be maintained to enhance audit independence and oversight effectiveness.

4.Executive Talent Development and Succession:It is recommended to establish a formal executive development and succession framework, incorporate long-term sustainability goals into performance evaluations, and report progress regularly to the Board to align compensation and promotion with long-term corporate development.

In addition to being submitted to the board of directors for review and improvement on March 17, 2023, various suggestions from external professional independent organizations will be used as a reference for the future work goals of the company's board of directors.

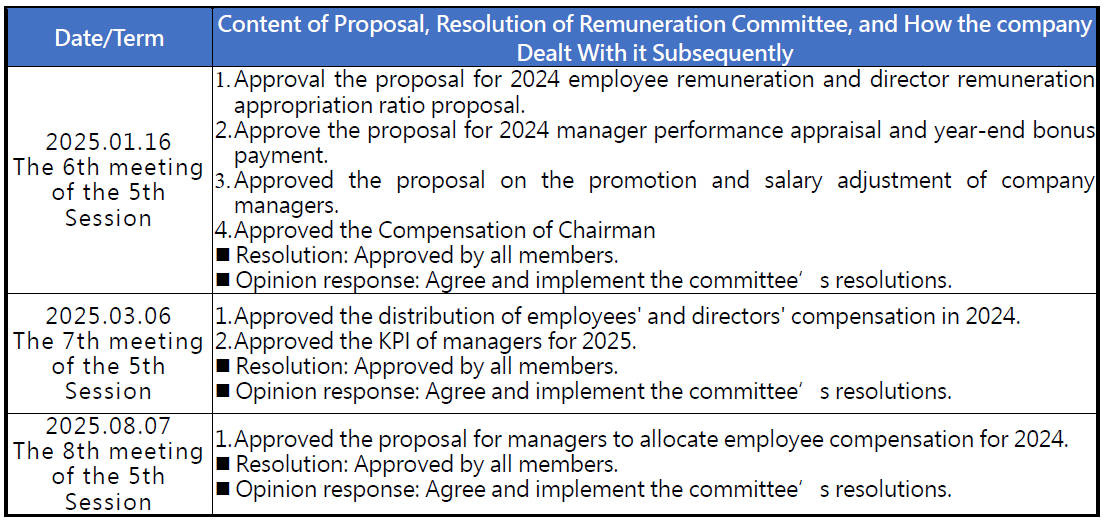

Meetings and resolutions of the Remuneration Committee in 2025

According to the company's Remuneration Committee Charter, the Committee shall exercise the care of a good administrator to faithfully perform the following duties and present its recommendations to the board of directors for discussion:

1. Periodically reviewing this Charter and making recommendations for amendments.

2. Establishing and periodically reviewing the annual and long-term performance goals for the directors, supervisors, and managerial officers of this Corporation and the policies, systems, standards, and structure for their compensation.

3. Periodically assessing the degree to which performance goals for the directors, supervisors, and managerial officers of this Corporation have been achieved, and setting the types and amounts of their individual compensation.

1. Ensuring that the compensation arrangements of this Corporation comply with applicable laws and regulations and are sufficient to recruit outstanding talent.

2. Performance assessments and compensation levels of directors, supervisors, and managerial officers shall take into account the general pay levels in the industry, the time spent by the individual and their responsibilities, the extent of goal achievement, their performance in other positions, and the compensation paid to employees holding equivalent positions in recent years. Also to be evaluated are the reasonableness of the correlation between the individual's performance and this Corporation's operational performance and future risk exposure, with respect to the achievement of short-term and long-term business goals and the financial position of this Corporation.

3. There shall be no incentive for the directors or managerial officers to pursue compensation by engaging in activities that exceed the tolerable risk level of this Corporation.

4. For directors and senior managerial officers, the percentage of bonus to be distributed based on their short-term performance and the time for payment of any variable compensation shall be decided with regard to the characteristics of the industry and the nature of this Corporation's business.

5. No member of the Committee may participate in discussion and voting when the Committee is deciding on that member's individual compensation.

The committee of the company held 3 meetings in 2025, and the actual attendance rate of all members was 100%. The work priorities completed this year are as follows:

| Title | Name | Attendance in Person | By Proxy | Attendance Rate(%) | Remarks |

| Independent Director | Chen, John-Sea | 3 | 0 | 100% | |

| Independent Director | Sun, Chu-Wei | 3 | 0 | 100% | |

| Independent Director | Chung, Kai-Hsun | 3 | 0 | 100% |

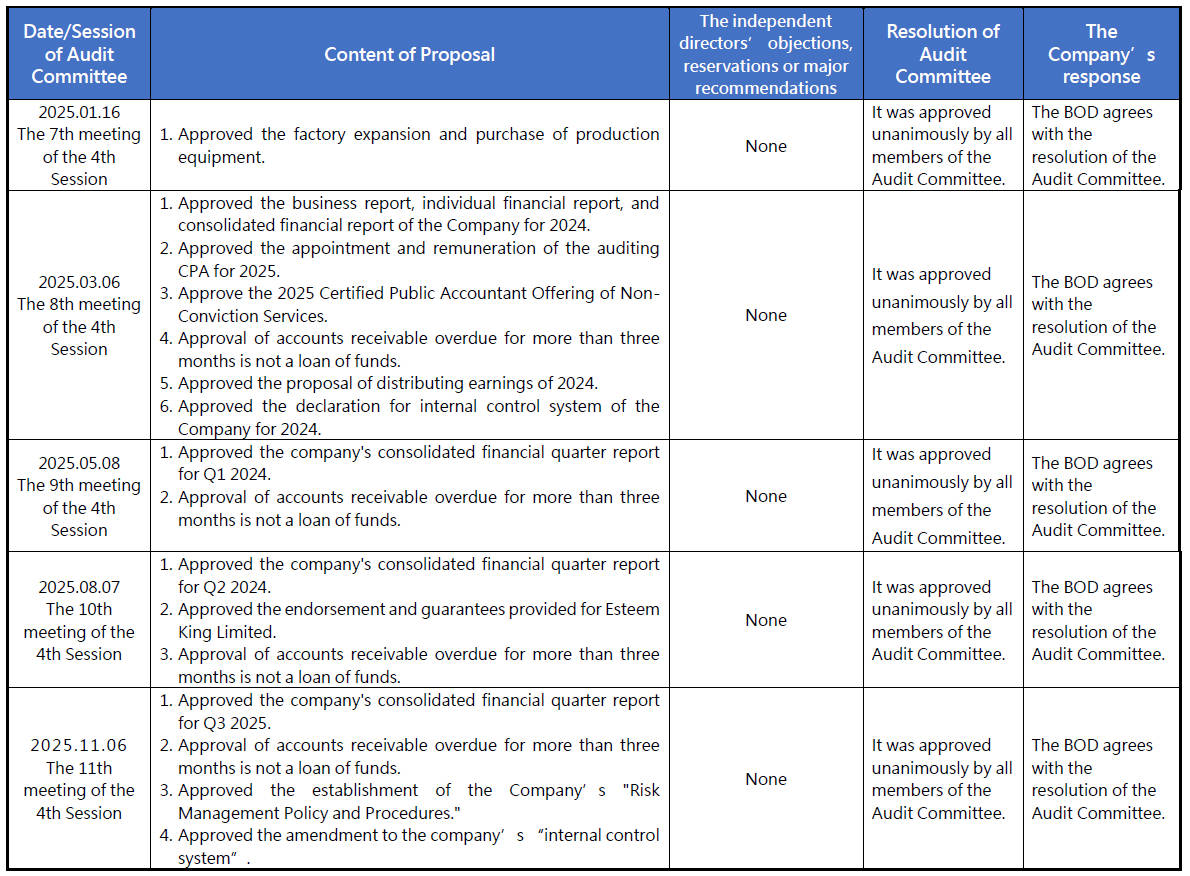

Meetings and resolutions of the Audit Committee in 2025

The audit committee of the company held 5 meetings in 2025, and the actual attendance rate of all members was 93%. The work priorities completed this year are as follows:

1. Assessment of the effectiveness of the internal control system.

2. Asset transactions.

3. Loans of funds, endorsements, or provision of guarantees of a material nature.

4. Appointment and remuneration of CPAs, and periodic assessment of their independence and competence.

5. Annual and quarterly financial reports.

6. Other material matters as may be required by this Corporation or by the competent authority.

| Title | Name | Attendance in Person | By Proxy | Attendance Rate(%) | Remarks |

| Independent Director | Chen, John-Sea | 4 | 1 | 80% | |

| Independent Director | Sun, Chu-Wei | 5 | 0 | 100% | |

| Independent Director | Chung, Kai-Hsun | 5 | 0 | 100% |